What’s the deal?

Facebook ads work because when done right, they’re personal, relevant and easy to measure. The Audience Network brings those same features to other app and mobile website experiences, providing marketers with even more scalability for their regular Facebook campaigns. The Audience Network is essentially a collection of mobile apps where Facebook advertisers can serve ads using the same targeting and measurement tools that they use on Facebook.

The Audience network is for third party (non-Facebook) websites and apps where marketers place ads, using the same Facebook ad formats and interface. These ads are notoriously inexpensive because they can end up on any number of websites or apps, without the advertiser having any visibility into which ones. Facebook’s Audience Network is a new way for advertisers to extend their campaigns beyond Facebook and into other mobile apps.

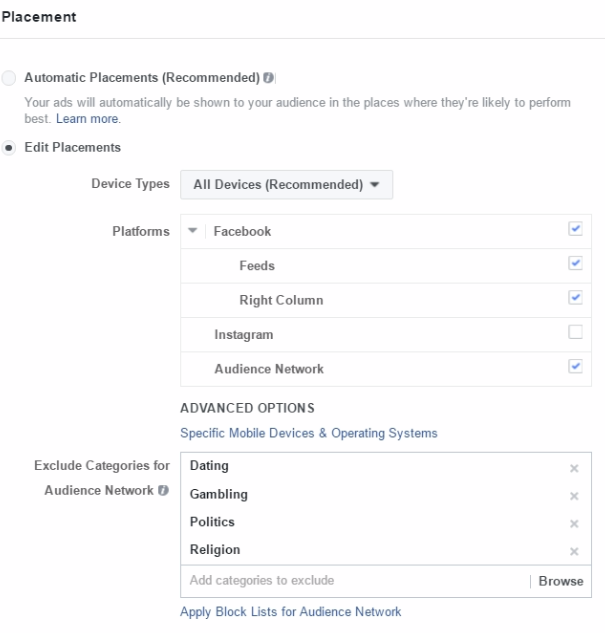

Category Blocking

This new feature gives you the ability to block ad placements on websites which are categorized to have specific content that could potentially tarnish your brand. The current categories include: gambling, politics, religion, and dating. If you want to be more specific, you can also upload a list of URLs from which you know you do not want your users coming from. You can read the full announcement here.

Why does this matter?

Sure, we’ve been able to do this on the GDN and other Display Networks for a few years now. So, this might seem like a small feature to add, but the signal it sends digital marketers is not. Since the beginning, they’ve continued pushing against Google for dominance in this space. Since the removal of Facebook Ad Exchange, it has been more difficult for outside ad exchanges/ display vendors to leverage Facebook. Facebook is squeezing them out of the game. The addition of Instagram placement as part of Facebook’s media buying workflow is part of their overall strategy to have all buyers do everything through the Facebook interface, one could argue.

Facebook’s success has come as a bit of a surprise – many research firms published reports forecasting that Google would stay in the lead. Take a look at the reversal from eMarketer’s predictions on Facebook vs. Google display ad revenue in 2013 vs. 2015:

2013:

2015:

Facebook is gaining ground in the display game

Once Facebook gains the reach (scale/size) they need with Audience Network, they’ll have an extremely tempting, one-stop advertising solution for display/social marketers of all stripes. Facebook does not need to rely on browser cookies to identify user demographics and interests, they already have vast sets of information profiles on hand from their audiences who log in daily. That means they can connect across devices (mobile web, app, and desktop) and have deeper insights into the impact of advertising on the online purchasing behavior of consumers. Facebook’s interface also makes it easy to buy media across various types of placement formats – Instagram, Facebook Newsfeed, and Audience Network ads are possible for the same campaign within the same workflow by simply checking a box.

Other thoughts

It will be interesting to see if Facebook will start making Audience Network placements visible, letting you comb through your placements and add or delete them as needed.

This will likely drive up the cost of Audience Network placements, as more visibility and control means better quality placements and increased competition. Native Facebook and Instagram placements are still the most expensive, but Audience Network’s prices are likely to rise.